Hosting fiyatları 2024 makalemizle en güncel fiyat sitesi Fiyatlist.com olarak sizlerleyiz. Yazımızda websitenizi barındırmak için temel ihtiyaçlarınızdan olan hosting ihtiyaçlarınız için, Türkiye’nin en çok bilinen hosting firmalarındaki fiyatları araştırdık ve listeledik. Listemizde isimtescil, alastyr, turhost, natro gibi firmaların güncel hosting fiyatları yer almaktadır. (Fiyatlar içeriğin girildiği tarihte günceldir, sonrasında kur farkları nedeniyle değişmeler olabilir.)

Hosting Fiyatları 2024

İçeriğimizin devamında her firmanın kendine ait hosting fiyatlarını liste olarak vereceğiz. Her hosting firmasının ilgili başlığında hosting paketlerinin içeriklerine dair detay görselleri yer almaktadır.

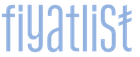

İsimtescil Hosting Fiyatları 2024

İsimtescil firmasına ait güncel hosting fiyat listesi aşağıdaki gibidir.

- EKO HOSTING PAKETİ 1,49$/Ay

- SUPER EKO HOSTING PAKETİ 1,91$/Ay

- STANDART HOSTING PAKETİ 2,86$/Ay

- SILVER HOSTING PAKETİ 6,25$/Ay

- GOLD HOSTING PAKETİ 12,99$/Ay

- PLATINIUM HOSTING PAKETİ 14,99$/Ay

- BUSINESS HOSTING PAKETİ 27,99$/Ay

- PROFESSIONAL HOSTING PAKETİ 41,99$/Ay

- WORDPRESS HOSTING PAKETİ 1,99$/Ay

Turhost Hosting Fiyatları 2024

Turhost firması hostinglerini farklı paketler halinde sunmaktadır. Fiyat listesi aşağıdaki gibidir.

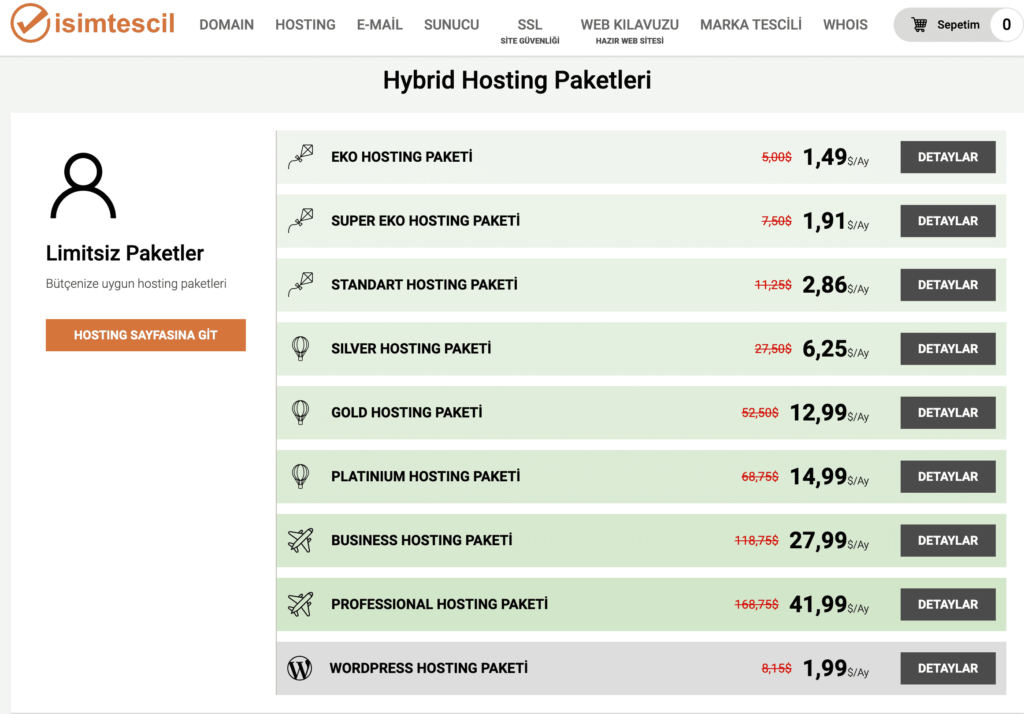

Turhost WordPress Hosting Fiyatları 2024

- WP-Giriş Hosting Paketi: $ 0.89 / ay

- WP-Başlangıç Hosting Paketi: $ 1.49 / ay

- WP-Limitsiz Hosting Paketi: $ 2.79 / ay

- WP-Limitsiz3 Hosting Paketi: $ 5.49 / ay

- WP-Portal Hosting Paketi: $ 12.99 / ay

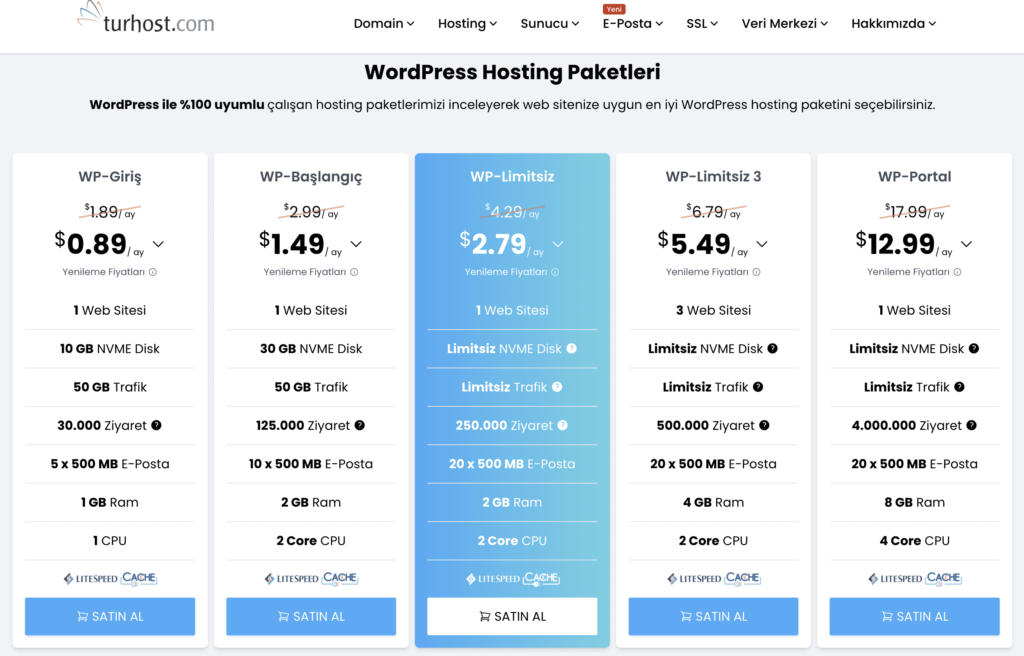

Turhost Linux Hosting Fiyatları 2024

Turhost Linux Hosting Paketleri

| Paket Adı | Ücret |

|---|---|

| Bireysel Mini | $0.69 / Ay |

| Bireysel Başlangıç | $1.34 / Ay |

| Bireysel 3 Başlangıç | $2.12 / Ay |

| Bireysel Limitsiz | $2.46 / Ay |

| Bireysel Limitsiz 2 | $2.98 / Ay |

| Bireysel Limitsiz + | $3.85 / Ay |

| Bireysel Limitsiz ++ | $4.84 / Ay |

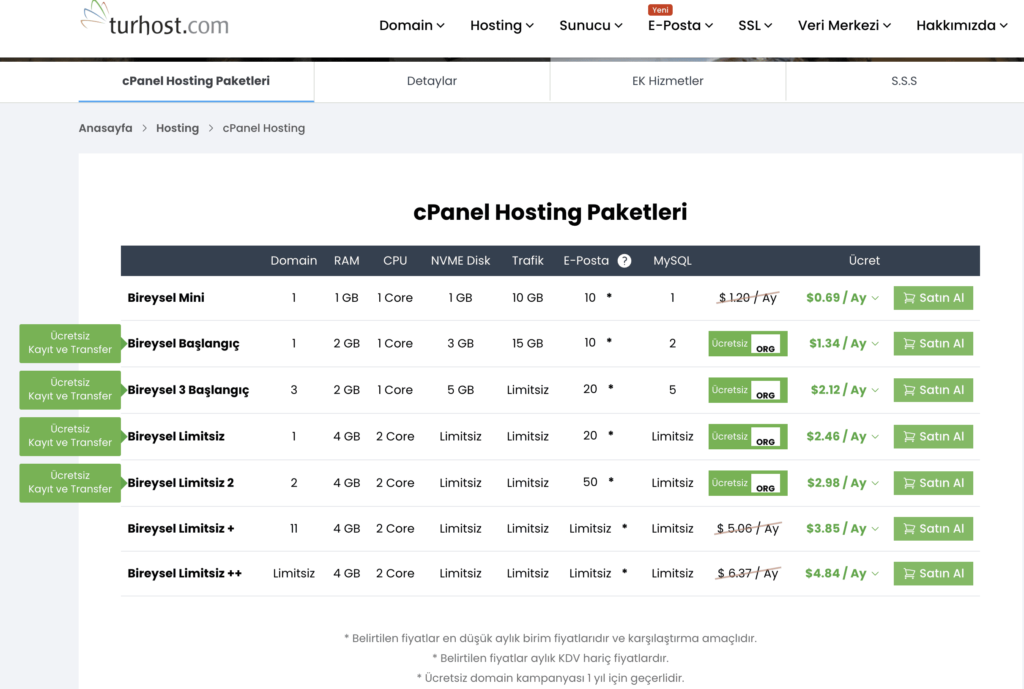

Turhost Cpanel Hosting Fiyatları 2024

cPanel Hosting Paketleri

| Paket Adı | Ücret |

|---|---|

| Bireysel Mini | $0.69 / Ay |

| Bireysel Başlangıç | $1.34 / Ay |

| Bireysel 3 Başlangıç | $2.12 / Ay |

| Bireysel Limitsiz | $2.46 / Ay |

| Bireysel Limitsiz 2 | $2.98 / Ay |

| Bireysel Limitsiz + | $3.85 / Ay |

| Bireysel Limitsiz ++ | $4.84 / Ay |

Natro Hosting Fiyatları 2024

Natro firması hostinglerini farklı paketler halinde sunmaktadır. Fiyat listesi aşağıdaki gibidir.

Natro Sınırsız Hosting Fiyatı 2024

- Başlangıç Hosting Paketi: 0,89$/ay

- Süper Başlangıç Hosting Paketi: 1,09$/ay

- Web Expert Hosting Paketi: 2,99$/ay

- Sınırsız Hosting Paketi: 2,89$/ay

- Sınırsız Pro Hosting Paketi: 2,99$/ay

- Sınırsız Xtreme Hosting Paketi: 6,99$/ay

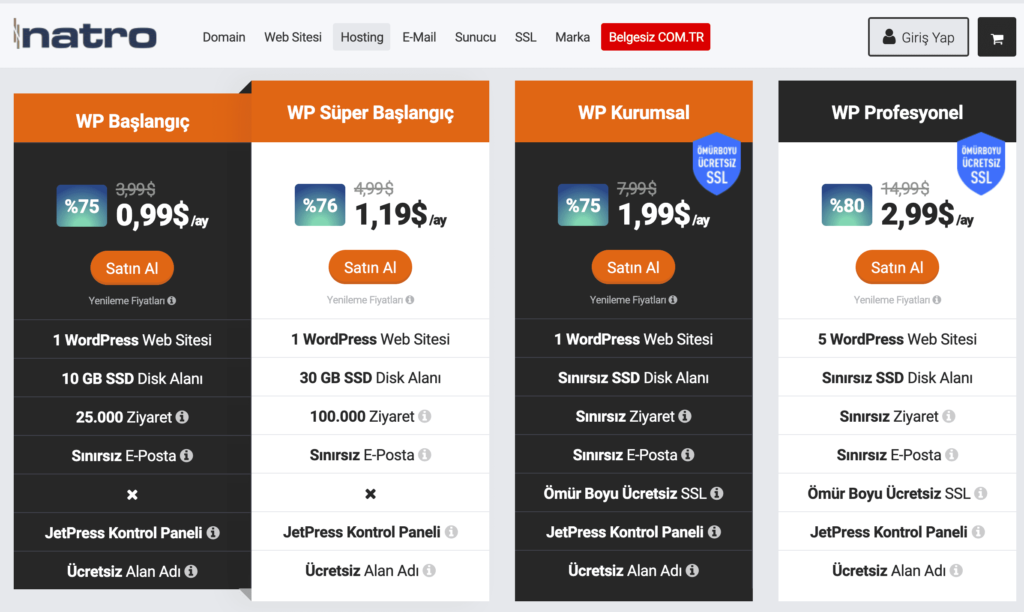

Natro WordPress Hosting Fiyatı 2024

Natro wordpress siteler için özel yapılandırılmış kullanımı kolay hosting seçeneği sunmaktadır.

- WP Başlangıç Hosting Paketi: 0,99$/ay

- WP Süper Başlangıç Hosting Paketi: 1,19$/ay

- WP Kurumsal Hosting Paketi: 1,99$/ay

- WP Profesyonel Hosting Paketi: 2,99$/ay

Natro E-ticaret Hosting Fiyatı 2024

Natro e-ticaret siteleri için özel optimize edilmiş, ödeme sistemi entegreli hosting seçeneği sunmaktadır.

- e-Başlangıç Hosting Paketi: 3,99$/ay

- e-Girişimci Hosting Paketi: 4,99$/ay

- e-Uzman Hosting Paketi: 8,99$/ay

- e-Profesyonel Hosting Paketi: 14,99$/ay

Alastyr Hosting Fiyatları 2024

Alastyr firması hostinglerini farklı paketler halinde sunmaktadır. Fiyat listesi aşağıdaki gibidir.

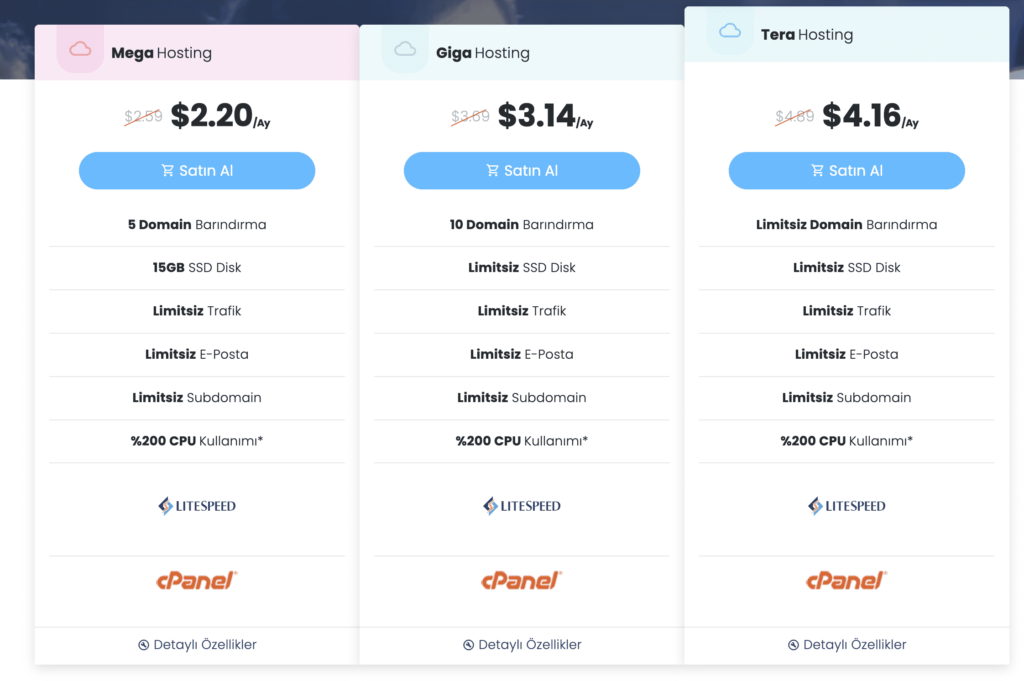

Alastyr Sınırsız Cpanel Hosting Fiyatları 2024

- Mega Hosting Paketi: 2,20$/ay

- Giga Hosting Paketi: 3,14$/ay

- Tera Hosting Paketi: 4,16$/ay

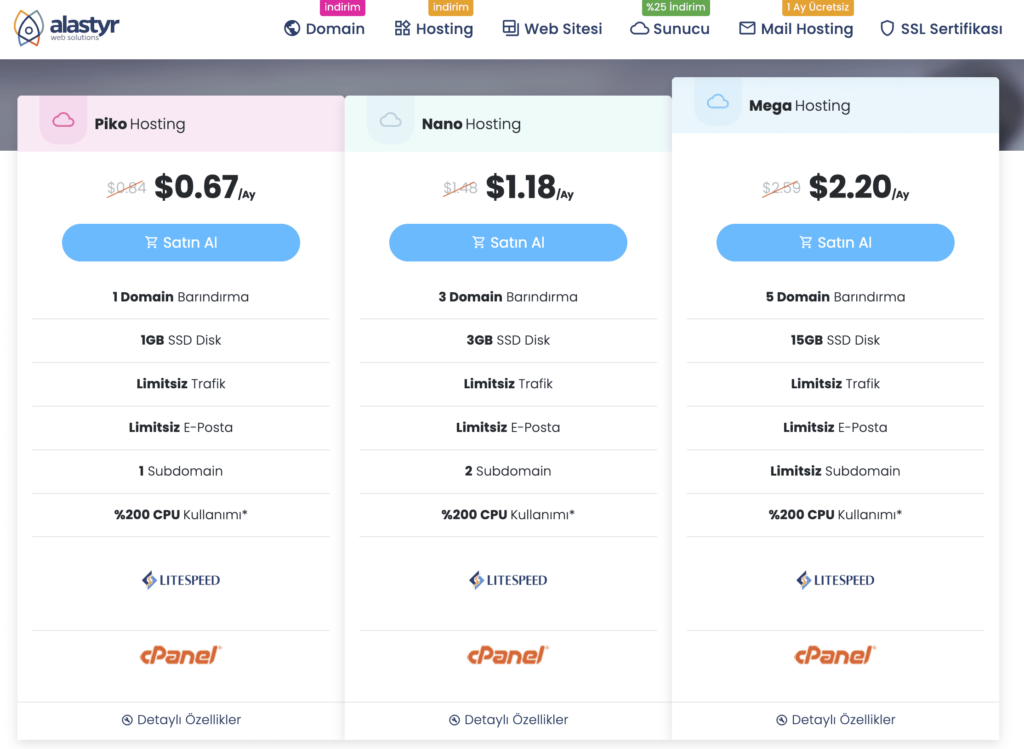

Alastyr Ekonomik Uygun Fiyatlı Ucuz Hosting Fiyatları 2024

- Piko Hosting Paketi: 0,67$/ay

- Nano Hosting Paketi: 1,18$/ay

- Mega Hosting Paketi: 2,20$/ay

Hosting Nedir?

Web hosting, web sitenizin internet üzerinde yayınlanabilmesi için gereken teknoloji ve hizmetler bütünüdür. Bir web hosting şirketi, sitenizi barındıran ve internet kullanıcılarının tarayıcılarından sitenize erişmelerini sağlayan özel bilgisayarlara (sunuculara) sahiptir.

Hosting Çeşitleri

Hosting servisleri birkaç çeşittir. Her biri, farklı ihtiyaçları karşılamak için tasarlanmıştır.

Paylaşımlı Hosting

Paylaşımlı hosting, birçok siteyi aynı sunucuda barındırır. Bu, genellikle küçük ve orta ölçekli siteler için idealdir.

Özel Sunucu Hosting

Özel sunucu hosting, size tam kontrol sağlayan bir sunucu tipidir. Daha büyük siteler ve karmaşık web projeleri için idealdir.

VPS Hosting

VPS (Virtual Private Server) hosting, paylaşımlı ve özel sunucu hostingin arasında bir yerdedir. Kendi kaynaklarına sahip olmasına rağmen, bir sunucunun birden fazla sanal parçada paylaşıldığı bir ortamda çalışır.

Bulut Hosting

Bulut hosting, genellikle ölçeklenebilirliği ve güvenilirliği ile bilinir. Birden fazla sunucunun birleşimini kullanarak yüksek performans sağlar.

Hosting Seçerken Nelere Dikkat Edilmelidir?

Hosting seçimi websitelerimizin geleceği açısından hayati önem taşımaktadır. Websitenize en uygun hostingi seçmek ilerleyen süreçte hem performans hem de maddi açıdan sorun yaşamamanız adına önemlidir.

Uygun Fiyatlı Hosting

Bütçeniz ne olursa olsun, ihtiyaçlarınızı karşılayacak bir hosting planı bulabilirsiniz. Fiyat, genellikle paylaşılan, VPS, özel ve bulut hosting arasında değişir.

Performans ve Hız

Hosting servisini seçerken, site yüklenme hızları ve genel performans önemlidir. Bu, ziyaretçilerin deneyimini doğrudan etkiler. Bütçeniz dahilinde farklı hosting firmalarının sattığı hostingleri karşılaştırarak satın alma yapmalısınız.

Müşteri Desteği

Hosting hizmeti alırken iyi müşteri hizmetleri önemlidir. Sorunlarla hızlı ve etkin bir şekilde başa çıkabilen bir ekibe ihtiyacınız olacaktır. Websitenizde bir problem olduğunda anında çözüm üretebilen bir firma ile çalışmanız her zaman avantajınızadır.

Hangi hosting türünü seçmeliyim?

İhtiyaçlarınıza bağlıdır. Küçük siteler genellikle paylaşımlı hostingi, büyük siteler özel sunucu veya VPS hostingi tercih eder.

Hosting Fiyatları 2024 Yılında Hangi Aralıklardadır?

Hosting Fiyatları 2024 yılında satın aldığınız firma ve seçtiğiniz hosting paketinin özelliği ile değişmekle birlikte, aylık 0,67$’dan başlayıp 14,99$’a kadar çıkmaktadır.

En İyi Hosting Firması 2024 Yılında Hangi Firmadır?

En iyi hosting firması, en iyi performanslı hostingleri müşterilerine en uygun maliyetlerle sunan ve 7/24 çözüm odaklı müşteri desteği ile çalışan firmalardır. Ülkemizde natro, isimtescil, alastyr, turhost gibi firmalar en çok bilinen iyi firmalardır.